Oportun Review – An App to Automate Your Savings

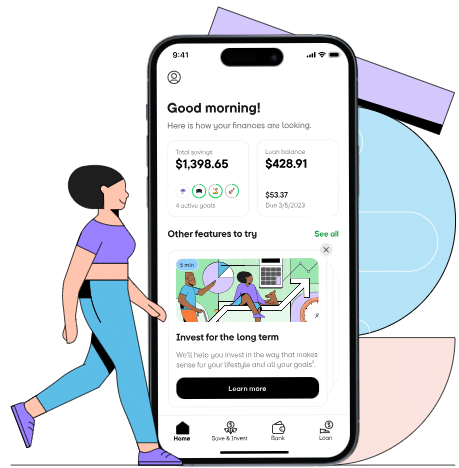

Can a simple app help you save money painlessly? That’s the goal of the Oportun app. In our Oportun review, we put it to the test to see just how well it works. Automating your finances is a cornerstone of sound money management. Chief among automation priorities is savings. But how can you automate savings…