Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

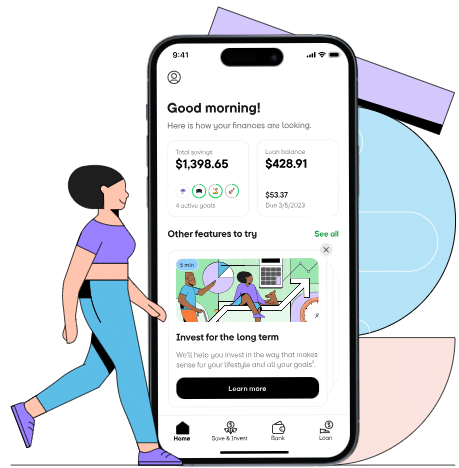

Can a simple app help you save money painlessly? That’s the goal of the Oportun app. In our Oportun review, we put it to the test to see just how well it works.

Automating your finances is a cornerstone of sound money management. Chief among automation priorities is savings. But how can you automate savings so it happens without you even thinking about it?

Oportun is an app that tracks your spending to determine how much is available for savings. Then it makes automatic withdrawals from your checking into your savings. The basic idea is to enable you to save money–automatically–and even without your knowledge.

It’s one of a growing number of savings apps enabling people to save money without changing their behavior. What makes Oportun unique is that it’s completely automated. You go about your financial business, just like usual, and the app skims off small amounts of extra cash in your checking account. Then it moves it into savings.

Let’s see how Oportun works.

What is Oportun and What Can it Do for You?

Oportun (formerly Digit) – is based in San Francisco and was launched in 2013. The app has helped users save more than $2.3 billion in interest and fees.

The major benefit of Oportun is that it enables non-savers to save money. If you count yourself among that group, Oportun is an app for you. It can enable you to save money without any effort on your part. It may only be a couple of hundred dollars per month, but that’s a start. If Oportun can generate $250 per month in savings, you’ll have $3,000 after one year.

That’s a lot of money if you haven’t been a saver in the past. Perhaps even more importantly, Oportun can kickstart the savings habit. People often fail to save mainly because they never get started. But if you can accumulate savings passively, it might create the incentive for you to make the transition from non-saver/debtor over to saver/investor.

Sometimes all you need is a little push–and that’s exactly what Oportun does.

Oportun Features and Benefits

Oportun automatically determines a safe amount to withdraw from your checking account, based on your lifestyle, income, and spending patterns. It does this without any input from you.

When you sign up for the app and connect your checking account, Oportun reviews your spending habits. Oportun can support more than thousands of banks and credit unions across the U.S. (Note: PayPal, Green Dot, and NetSpend aren’t supported by Oportun). Oportun is only available for U.S.-based customers and banks. But they are planning to expand internationally in the future. The app can only accommodate one checking account.

Oportun has no minimum account balance requirements.

If extra money is available in the account after the review, the money will be moved into your Oportun account. Oportun’s savings algorithm uses five factors to determine how much money to transfer into savings:

- Linked checking account balance

- Upcoming income, including paychecks or predicted irregular income

- Upcoming bills

- Recent spending

- Any savings controls you set (see Safe Saving Level under Signing Up For an Oportun Account below)

Oportun reviews your checking account each day to look for savings. However, transfers into savings typically occur two or three times per week on average. They also indicate that the average amount transferred is between $10 and $30 per transfer. These numbers can be higher or lower, depending on your own spending patterns.

What about your credit card activity? Oportun doesn’t work with credit cards. But that’s not an issue since your monthly payments on those cards should be reflected in your checking account. In that way, your credit cards are considered by the app, even if not directly.

Savings Bonuses. When you save with Oportun for three consecutive months, you will be rewarded with a 0.10% annualized Savings Bonus. The bonus is automatic, and no account minimums are required in order to qualify. The bonus is paid on a pro-rata basis every three months and is based on the average daily balance in your Oportun account.

Oportun Overdraft Protection. Oportun will move money from your savings back into your bank account if your checking account balance falls below a certain amount. But if your checking account is ever overdrawn as a result of Oportun’s automatic savings withdrawals, Oportun will reimburse overdraft fees up to two times. However, they promise that an overdraft will be “very unlikely.”

Oportun Retirement IRA and Investing Portfolio

Oportun now offers an IRA – a tax-advantaged Oportun Retirement IRA – or an investing portfolio. Your first investment in either account will happen 30 days after you set up your investment or retirement fund. Additional contributions will then be made on the same date every month thereafter. They even offer a “Boost” option, to allow you to increase your investment or IRA contributions at any time.

To set up an investment account, you’ll need to tap Investments on the home screen of the app. From there you’ll be able to choose whether you want the funds to go into a long-term wealth investment account or an IRA.

Like most robo-advisors, you’ll be asked a series of questions to determine your risk tolerance, so that the proper portfolio is established for you. This can be either conservative, moderate, or aggressive. You’ll also be asked a series of questions to verify your identity, as well as your employment status and current income level.

It appears the investment and IRA services were rolled out in October 2020. Either account is managed by Oportun Advisors, LLC, which was formed in August 2019, as an investment firm registered as an investment advisor with the Securities and Exchange Commission.

Either plan is covered under your $5 per month basic subscription fee but may involve fees related to specific investments, such as mutual funds and exchange-traded funds. Either type of fund can be used in the construction of your portfolio.

The information provided by the company does not offer any guidance on specific portfolio construction but does mention investments in equities, fixed-income securities, real estate investment trusts, foreign securities, and US government securities through either mutual funds or ETFs.

Oportun Pricing and Fees

Oportun gives you the use of the app free for 30 days. Once the free trial expires, the fee is $5 per month. The service can be canceled at any time, with no future obligation.

Oportun will also charge you a fee of $0.99 on instant withdrawals from your account. Standard withdrawals will typically be deposited into your external account within 1 to 2 business days. But if you need an instant transfer, you can get the funds moved in a matter of minutes by paying the instant withdrawal fee.

Signing Up For an Oportun Account

You can sign up for the Oportun app on Google Play or The App Store. You can do that by entering your mobile phone number and creating a unique password. Once you’ve downloaded the app, you’ll connect it to your bank account, though you won’t need to provide either your bank routing number or your personal account number.

When you open an account, you’ll start by setting a checking account minimum balance. You do this by texting Minimum to Oportun. Oportun recommends setting a minimum threshold of at least $200, but it’s really up to you.

Safe Saving Level. After you open an account, you’ll start by setting a checking account minimum balance, which they refer to as a Safe Saving Level.

Oportun recommends setting a minimum threshold of at least $200, but it’s really up to you.

Oportun will then analyze your banking activity then transfer small amounts of cash into your Oportun account every few days. The amounts transferred will be based on an analysis of your income and spending patterns within your checking account with the bottom level set by you for the Safe Saving Level.

You can add a secondary user to your account. That person will be able to use the account the same way you do, but they will not be able to log in to the administration dashboard and make changes to the account, he or she will be able to move funds to the connected checking account, as well as view savings balances.

You’re given an Oportun account, complete with a Rainy Day Fund. That is the savings account into which withdrawals from your checking account will be moved, referred to as a Rainy Day Fund. The purpose is to make sure that you have an emergency fund in place, and Oportun will fund this account by default. The app does not allow you to set a goal amount or an end date for the fund, or to delete it completely. But you will have the option to pause the Rainy Day Fund in favor of funding other savings goals.

And of course, you’re always free to withdraw funds from that account, and into a savings account of your own choice. No minimum balance is required for this account.

Your first automated savings should happen within two or three days. Monthly statements will be available in PDF.

Control how much you save. You can even regulate how much you save. For example, if you want to save more, you can simply message “Save More” to Oportun and increase the amount that’s being saved. If you change your mind, you can just text back “Save Less”, and your savings level will be restored to a Minimum. You can even text “Pause” if you want to take a break from savings.

You’re also free to make manual transfers into your Oportun account at any time, which can be done by text.

Oportun withdrawals. You can make withdrawals on a 24/7/365 basis, by messaging Oportun “Withdraw” if you want to move money back into your checking account. There are no limits as to how often you can make these transfers and no fees for doing so.

Account withdrawals are free of charge with standard withdrawals. A withdrawal made before 4:00 PM (Pacific Time) should arrive in your bank account on the next business day. Withdrawals made after 4:00 p.m. will be posted on the second business day. However, you can opt for an instant transfer for a fee of just $.99.

Unlimited Goals. You can set goals for any purpose, including an emergency fund (which is automatic), a vacation, paying off a debt, or saving for a very specific purpose, like funding an IRA or the purchase of a car.

Debt and Bill Payments. You can set expense goals so that Oportun will automatically apply saved funds toward paying down credit cards and student loan debt, as well as paying certain bills, like your phone bill.

Oportun Security

Oportun uses state-of-the-art security measures, including anonymizing and encrypting your information. This includes the use of 128-bit encryption to protect the transmission of data, as well as firewalls and other security precautions.

Funds held on deposit with Oportun are FDIC insured, up to $250,000 per depositor.

Mobile Support and Accessibility

The Oportun Mobile App is available on the App Store for iOS devices 10.3 and later, and watchOS 3.0 or later, and is compatible with iPhone, iPad, and iPod touch. It’s also available on Google Play for Android devices, 4.4 and up.

Customer Service and Support

This is limited to Oportun’s Help Page, which is more like a FAQ page. There’s no phone number and no live chat feature. The company doesn’t even publish its address on the website, though the Facebook page indicates that they’re located in San Francisco.

The closest thing to direct customer service contact is by email or by submitting a help request at Oportun.com/help. They indicate they’ll respond to all inquiries in less than 8 hours. Regular business hours are Monday through Friday, 9:00 AM to 5:00 PM, Pacific Time, excluding holidays.

Oportun Pros and Cons

Pros

- First-Time Savings — This is the perfect app for someone who isn’t a saver to become one.

- Incredibly Easy to Use — No special effort is required on your part to make savings happen.

- Rainy Day Fund — Oportun will automatically create an emergency fund for you, called the Rainy Day Fund to make sure you’re always covered for an unexpected expense.

- Overdraft protection — Oportun can pay up to two NSF charges if they accidentally overdraw your checking account.

- Investments and IRAs — Oportun now offers members investment accounts and IRAs in order to save smartly for the future.

Cons

- The $5 monthly fee — It may strike some as strange to have to pay a fee in order to save money, in addition to the fact that the fee will cut into savings.

- Poor interest rate – 0.10% APY in this environment is bad, so it is recommended that you transfer your savings to a high-yield savings account to maximize interest potential.

- Not available Internationally — Oportun is currently unavailable to non-U.S. residents, and cannot be connected to non-U.S. banks.

- Only one checking account can connect to the app — If you have two or more, you have to choose the one that has the most activity to get the biggest benefit.

- Customer contact is very limited — There is no way to contact customer service by phone. Email and the in-app chat are the only options.

Oportun Alternatives

Acorns is probably the best-known micro-savings and investment app. It helps you accumulate savings through a process they refer to as “Round-Ups.” By connecting the app to your checking account and credit cards (yes, you can connect multiple accounts, enabling you to accumulate even more round-ups), you can make a charge of $8.30, then the app will charge your bank account or credit card $9 and transfer $0.70 into your investment account.

You can even multiply the amount of change transferred to an investment account, or make recurring or one-time transfers into the account. Acorns not only offers a basic investment account but also an IRA and even accounts for minors. Acorns charges $3 per month if you add the IRA option to the basic investment account, or $5 per month if you want to start investing for a child.

Chime is a financial app that can help you save money by using round-ups to build your savings. Since they can accept payroll direct deposit payments, you can automatically have your pay transferred to your savings account as soon as you get paid. And since it’s an automatic process, you won’t need to do anything to make it happen.

Chime is completely free to use, which gives you access to 100% of your money. The money you don’t spend on fees is available for additional savings and the current Chime APY is %.

Learn More: Best Apps to Build Savings Habits and Savings Goals

What Others Are Saying About Oportun

To provide a truly objective opinion of Oportun I’ve turned to some outside opinions and information sources about the company and the app.

The company does not have a profile page set up with TrustPilot, but it scores a rating of 4.7 stars out of 5 among more than 277,000 iOS users on the App Store, and 4.2 stars out of 5 from more than 46,000 Android users on Google Play.

BBB Rating. The Better Business Bureau has given Oportun a rating of B- (on a scale of A+ to F), which is a generally positive rating. 135 complaints have been filed against the company within the past three years. A cursory review of the first 50 or so complaints shows that every one of the complaints was answered by Oportun, and close to half were resolved to the customer’s satisfaction.

On balance, Oportun seems to be keeping its hundreds of thousands of users generally happy, which should give you more confidence in the product if you choose to sign up.

Our Methodology for Rating Oportun

I determined the scoring of Oportun by comparing the basic features to the competition like Acorns, Chime, and Stash Invest. The fee of $5 per month is certainly reasonable for the services provided especially if you take advantage of the investment or IRA options. But it’s higher than the $1 per month charged by the competition.

Oportun has plenty of features, that match or exceed its competitors. Where the app loses points is on customer service and for it’s low-interest rate. There is no phone support, so you’re limited to contact by email or in-app help with a response time of up to 48 hours.

Who is Oportun For?

Sign up for Oportun if you believe you have enough room in your budget – but that you can’t seem to find on your own – to save at least $100 per month. If you can’t save at least that much, it may not be worth paying the monthly fee for the service. For example, if your budget is really stretched thin, the $5 monthly fee may not justify saving $10, $15, or $20.

On the other hand, if debt is the main reason your budget is so tight, Oportun does offer a way to redirect funds into debt reduction – it’s one of their stronger features. If the app can direct even some extra money (like something substantially more than $5) toward paying down credit cards, it may help you to gradually get more control over your budget.

As the credit card balance(s) drop, so will your monthly payments. As they do, you can either allocate the additional cash flow back into paying down the cards, or toward other savings goals.

Should You Sign Up With Oportun?

In evaluating Oportun and taking a deep dive into its various services, I think this is an app that can help anyone who has not been able to save in the past but wants to become a committed saver in the future. They offer a combination of passive saving capability and targeted savings goals, like debt reduction, investing, and even saving for retirement.

I am however concerned that a large number of features which is ultimately an advantage can make the app difficult to master when you first start out. Similar apps, that use round-ups, work more passively. You just need to connect a competing app with a spending account, and the savings take place automatically. Oportun has a lot of moving parts that need to be understood and worked into your financial profile.

At first, I was excited about the recent addition of the investment and IRA options. But in digging into the details, I’ve found there are very few. The programs are brand-new, and no information is provided in regard to specific investments or allocations. As an aspiring robo-advisor, it would be helpful if Oportun would publish important details, like the frequency of rebalancing (or if it’s even offered) or the capability of dividend reinvestment.

Until that information is available, and a track record on the investment side of the service is better established, it’s best to discount Oportun’s investing and IRA features until more is known.

The fee of $5 per month is admittedly higher than the competition. But Oportun also offers more services in exchange for that fee. It’s not just the basic ability to save money, but also to set goals, pay off debt and invest for the future. And if the IRA and investment services prove competitive, the fact that the basic fee also covers those services can make Oportun into a real bargain.

If you’re shopping for an app to help you save money, I recommend taking full advantage of Oportun’s 30-day free trial. Everyone has different financial habits and goals, and you may need to work with several savings apps before settling on the one that will work best for you. Oportun should be one of the candidates for the job.

Oportun App

Summary

Oportun is a great way to get your savings started and it has a lot of features to help automate the process. Unfortunately, it also has a very low-interest rate (APY).