Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

The banking universe is expanding, at least online. In the fintech space, there are dozens of new and relatively new online banks. They don’t usually look like traditional banks and bank accounts because they’re highly niche. Much like investment brokers, online banks specialize in product and service offerings for specific customers.

Three online banks that specialize in business banking are Azlo, Novo, and Bluevine. And while all three work in much the same way, each specializes in specific niche areas. If you run a small business, one of these banks could be the right banking service for you.

Azlo vs. Novo vs. Bluevine The Overview

After reviewing all three banks, I’ve found what each is best for Businesses:

| Novo | Small business owners with bad credit Businesses that conduct international transactions |

| Bluevine | Business loans Interest-bearing checking Paper checks Cash deposits |

| Azlo | Small business owners with bad credit |

About Novo

Novo is a limited fintech company for small businesses and freelancers. Like many new banks today, Novo is a fintech company with no physical branches.

Novo is a limited fintech company for small businesses and freelancers. Like many new banks today, Novo is a fintech company with no physical branches.

The company offers its banking services through a partnership with Massachusetts-based Middlesex Federal Savings. Novo focuses on a simple platform, often using third-party partners to provide specific business services. It’s designed to make banking easy for small businesses.

Read our full Novo Review

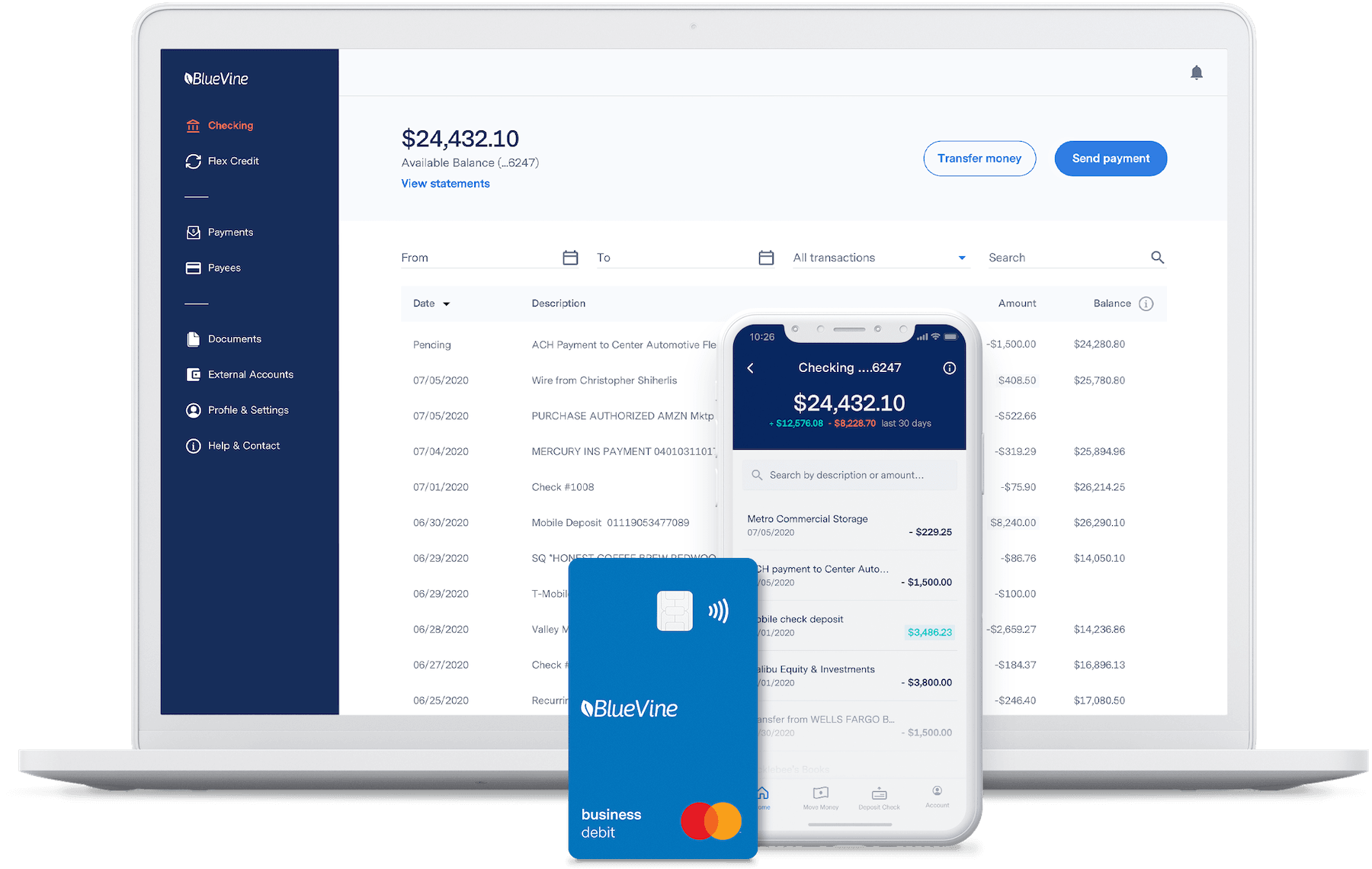

About Bluevine

Bluevine focuses on providing banking services for small businesses. They offer their online business checking account. They also provide small business loans and flexible business payments.

Bluevine focuses on providing banking services for small businesses. They offer their online business checking account. They also provide small business loans and flexible business payments.

Banking services are provided through Coastal Community Bank.

Like Azlo and Novo, Bluevine offers a streamlined banking platform with low fees. In fact, the company charges no monthly fees whatsoever.

Read our full Bluevine Review

About Azlo

Azlo is an online bank that services only small businesses. That includes entrepreneurs, independent contractors, and freelancers, in addition to small businesses. The company is partnered with BBVA.

Azlo is an online bank that services only small businesses. That includes entrepreneurs, independent contractors, and freelancers, in addition to small businesses. The company is partnered with BBVA.

Because it uses a simple online banking process, Azlo is able to keep fees low, without the monthly maintenance fee that you typically find with commercial accounts at traditional banks. Like many online banks, Azlo uses financial tools specifically designed to help freelancers and small business owners.

To open an account with Azlo, you must have a minimum of 25% ownership in the business, and it must be US-based. Azlo is not available for businesses connected with gambling, cryptocurrency, financial services, or cannabis.

Read our full Azlo Review

Basic Features

Novo Basic Features

ATM Network: None, but all ATM fees are reimbursed at the end of each month.

Customer Support: Monday through Friday, 9:00 AM to 6:00 PM, Eastern time, by phone, email, or through the app.

Mobile Accessibility: Android devices, 5.0 and up, and iOS devices, 11.0 and later. Includes mobile check deposit.

Security: All account balances are FDIC insured up to $250,000 per depositor.

Availability: All 50 states

Bluevine Basic Features

ATM Network: Over 38,000 no-fee ATMs nationwide through the MoneyPass network.

Customer Support: Available by phone and by email, though no specific days and hours of availability are provided.

Mobile Accessibility: Android devices, 4.2 and up, and iOS devices, 9.0 and later. Includes mobile check deposit.

Security: All account balances are FDIC insured up to $250,000 per depositor.

Availability: All 50 states

Azlo Basic Features

ATM Network: 55,000 fee-free in-network ATM machines through the Allpoint network.

Customer Support: Monday through Friday, 6:30 AM to 5:30 PM, Pacific time, by phone, and by email with a response time of one business day.

Mobile Accessibility: Android devices, 5.0 and up, and iOS devices, 11.0 and later. Includes mobile check deposit of up to $40,000 per month.

Security: All account balances are FDIC insured up to $250,000 per depositor.

Availability: All 50 states

Account Types and Loans

Related: The Best Small Business Credit Cards

Novo

Novo offers a single account: a free checking account for businesses. You can open an account with just $50, after which there is no minimum balance requirement. It also has the advantage of having no monthly fees and no hidden fees.

The checking account can be used to transfer funds, mail checks (though you are not provided with a supply of paper checks), and accept incoming wires. You can take advantage of the Bill Pay feature to pay bills and invoices electronically.

The bank does not have its own ATM network, nor does it participate in a third-party network. However, you’ll be reimbursed for ATM fees incurred at month-end for any terminal you use.

The account comes with a MasterCard business debit card that can be used anywhere MasterCard is accepted. There is a daily withdrawal limit of $1,000.

Novo does not offer deposit accounts, like savings or money markets, or certificates of deposit.

Novo does not offer loan products or credit cards.

Bluevine

Like Azlo and Novo, Bluevine offers only a business checking account: Bluevine Business Checking. The account is offered with unlimited transactions, live support, and no monthly fees.

One of the biggest advantages of a Bluevine business checking account is that it pays interest of [ct_brand_render field=ctsavings_interest_rate id=128004465 /] APY on balances over $1,000. Starting March 1, 2023, clients will need to meet one of the following monthly eligibility requirements to continue earning [ct_brand_render field=ctsavings_interest_rate id=128004465 /] for any month going forward:

- Spend $500 per month with their Bluevine Business Debit Mastercard®, which can be used everywhere Mastercard® is accepted

- Receive $2,500 per month in customer payments into their Bluevine Business Checking account via ACH, wire transfer, mobile check deposit, or directly from their merchant payment processing provider

The account also comes with 200 free checks and the Bluevine MasterCard debit card, issued by Coastal Community Bank.

Bluevine does not offer deposit accounts, like savings or money markets, or certificates of deposit.

Bluevine offers business financing secured by a general lien on the assets of your business and backed by a personal guarantee. Funding is between $5,000 and $5 million and is determined by your personal FICO score, as well as your business financials.

The Flex Credit program is a revolving line of credit. Once approved for a line, you can access funds from your credit line into your bank account. Monthly payments are debited from your account on a weekly or monthly basis for up to 12 months. You must have a personal credit score of at least 650 and generate at least $40,000 per month in revenue.

Azlo

Azlo only offers a business checking account. The account comes with a Visa business debit card that can be used fee-free at more than 55,000 in-network ATMs. Since it’s a business account, you can create personalized invoices and email them to your clients through the banking app. You can also accept card payments through third-party payment services, like PayPal, Square, and Stripe.

Checks can be deposited using the Azlo mobile app, with funds available in one to six business days. They offer free payments and standard transfers, as well as an unlimited number of transactions. The account has no minimum balance requirements.

Azlo does not have the capability to send international payments or make international transfers. The account also does not offer a check payment capability of any type.

Azlo offers an optional instant transfer capability of up to $2,000 per day, and $10,000 per month. The instant transfer option fees range from $1 to 2% per transfer.

Azlo does not offer deposit accounts, like savings or money markets, or certificates of deposit.

Azlo does not offer loan products or credit cards.

Related: Best Small Business Loans

Special Features

Novo

Novo offers the following special features:

- The bank does not check your credit history when you apply for an account.

- You can accept foreign checks, even through mobile check deposits.

- Send and receive international money transfers in major currencies with TransferWise.

- Connect the account to digital wallets, like PayPal, Venmo, Google Pay and Apple Pay.

- Integrates with Xero, a global accounting software serving 1.8 million subscribers; transactions are automatically saved and reconciled every hour.

- Discounts and credits from third-party providers, including Zendesk, HubSpot, Stripe ($20,000 in free credit card processing), Google Cloud ($3,000 in credits), salesforce essentials penji, and Winstar Payments ($250 off equipment and set up fees).

Bluevine

Bluevine offers the following special features:

- Pays [ct_brand_render field=ctsavings_interest_rate id=128004465 /] APY on account balances greater than $1,000.

- Online bank that offers paper check-writing.

- Offers business loans and flexible business payments.

- Online bank that accepts cash deposits through GreenDot.

Related: Best Bank Account for Startups

Azlo

Azlo offers the following special features:

- The bank does not check your credit history when you apply for an account.

- Integrates with Quickbooks, PayPal, Venmo, Stripe, Square, Kabbage, Xero and Wave.

- Azlo Envelopes is a budgeting tool to categorize and fund for savings toward a business goal.

Fees

Novo

Novo does not have monthly maintenance fees, nor do they charge any fees in connection with the use of your MasterCard business debit card.

The only fee the company charges is $27 for non-sufficient funds or return of deposited items.

Bluevine

There are no monthly service fees, and no fees for either incoming wires or insufficient funds. The only fee you’re likely to incur is $15 for outgoing wires. However, that fee is substantially lower than what traditional banks charge for outgoing wires.

GreenDot charges $4.95 per deposit when you make cash deposits at GreenDot locations. There is no additional fee charged by Bluevine.

Azlo

Azlo charges no monthly maintenance fees, incoming wire fees (both international and domestic) and no overdraft fees.

There is no charge for standard transfers, however the following fees apply under the Instant Transfer program:

$1 for instant outgoing transfers,

1% of the amount of incoming transfers greater than $500.

2% of the amount of incoming transfers less than $500.

FAQs

[faqs-content id=”VJPURJBERFHVDJE5TSD6QHXYUQ” /]

Learn More: How to Open a Business Bank Account Online

So which one is best?

The table below shows the basic features of all three popular banking apps, side-by-side:

| Minimum Initial Deposit | $0 | $0 | $50 |

| Accounts Offered | Business checking only | Business checking only | Business checking only |

| Loan Products | Business loans, and flexible business payments | None | None |

| ATM Network | Over 38,000 no-fee ATMs nationwide through the MoneyPass network | 55,000 fee-free in-network ATM machines through the Allpoint network | None, but all ATM fees are reimbursed at the end of each month |

| Customer Support | Available by phone and by email, though no specific days and hours of availability are provided | Monday through Friday, 9:00 AM to 6:00 PM, Eastern time, by phone, email, or through the app | Monday through Friday, 9:00 AM to 6:00 PM, Eastern time, by phone, email, or through the app |

| Account Security | FDIC insurance up to $250,000 | FDIC insurance up to $250,000 | FDIC insurance up to $250,000 |

| Mobile accessibility | Android and iOS mobile devices | Android and iOS mobile devices | Android and iOS mobile devices |

| Specializations | Pays interest of [ct_brand_render field=ctsavings_interest_rate id=128004465 /] APY on balances over $1,000; provides paper checks, offers loans, and accepts cash through GreenDot | No credit check; Integrates with Quickbooks, PayPal, Venmo, Stripe, Square, Kabbage, Xero and Wave | No credit check; accepts foreign checks and conducts international transfers |

| Fees | No monthly, NSF, or incoming wire fees; $15 outgoing wire fee, $4.95 to access cash through GreenDot | No fees for monthly maintenance, incoming wires or ATM usage; $1 to 2% fee for instant transfers | No monthly or ATM fees, $27 for NSF or returned items |

| Availability | All 50 states | All 50 states | All 50 states |

| Visit Bluevine | N/A | Visit Novo |

Though we work to determine the best product or service in a business or consumer category, the choice usually comes down to personal preference. Between Azlo, Novo and Bluevine, there is no single best bank. But one may be the best bank for you, based on your own personal preferences and circumstances.

Azlo is a perfect choice if you’re a small business owner with bad credit who also uses QuickBooks to run your business. It also has the advantage of requiring no minimum initial deposit or ongoing balance requirement.

Novo is also an excellent choice if you have bad credit, or if you conduct an extensive amount of international transactions. Not only do they provide the capability for international transactions, but they charge no fees for doing so.

If we do have to declare a winner among the three banks, it just might be Bluevine. Not only do they offer business checking with no minimum initial deposit, but your account also comes with paper checks and the ability to make cash deposits. And though they don’t offer a savings account option none of these three business banks do they do pay interest on checking account balances greater than $1,000. That’s pretty much a savings account equivalent. And if you need one, Bluevine is the only bank of the three that provides any type of financing. That includes business loans and a revolving line of credit.

Bottom Line

All three banks provide a low- or fee-free way to bank for your business. Which of the three banks is best for you depends on your small business banking needs.