Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

BlueVine is an online business bank that offers more than most of its competitors. On top of its business checking account, which has many valuable features, it offers financing to business owners through loans and lines of credit. This makes BlueVine great for business owners who have plans to expand and need a way to finance that expansion.

About Bluevine

Founded in 2013 and quickly expanding to three locations across the United States, Bluevine helps small and medium business owners streamline their finances. Bluevine also provides flexible funding that allows you to leverage your clients’ creditworthiness instead of relying solely on your own credit score.

Bluevine offers a complete suite of business banking services to help you keep your company in good financial standing:

- Business checking with no fees or monthly minimums plus interest paid

- A revolving line of credit to ensure your ability to continue to pay your vendors and other business expenses on time

Trustpilot users rate Bluevine 4.2 stars out of 5, based on more than 7,500 reviews.

Highlights

- Dedicated Account For: Checking, business financing

- Account types: Checking, business loan, business line of credit

- Min Opening Deposit: None

- Minimum balance required: None

- Monthly Fee: None

- ATM Access: MoneyPass network of 38,000+ ATMs

- Availability: Online

- 3rd Party integrations: Quickbooks

How Bluevine Works

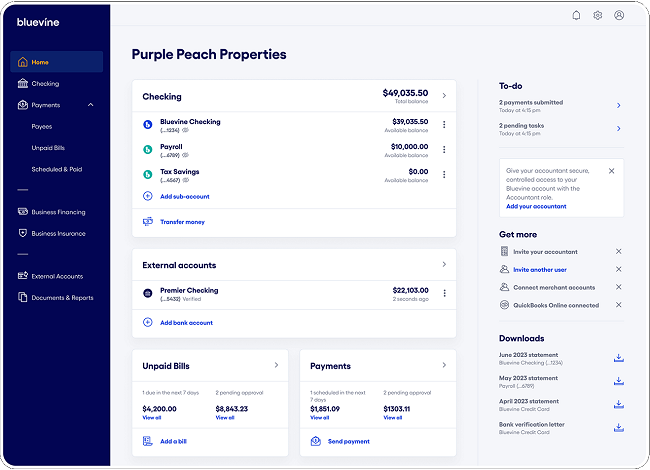

Online Business Checking

Bluevine’s online business checking accounts are FDIC-insured up to $250,000 through Coastal Community Bank. Bluevine requires no minimum deposit or balance and charges no monthly, NSF, or incoming wire fees. It only takes 60 seconds to sign up for an account.

You’ll be able to perform unlimited transactions, and Bluevine currently offers a % APY on all balances up to and including $250,000.

Easy Deposit Options

Bluevine’s mobile app makes it simple to deposit checks. Just take a picture of the check from within the app, and your deposited funds will typically become available in only two business days. If you need to deposit cash, Bluevine partners with GreenDot, which has more than 90,000+ locations nationwide. You can also transfer money easily between Bluevine and other bank accounts using wire transfer options.

Streamlined Payment Options

With Bluevine, you can pay vendor invoices and bills quickly and easily. Send payments using your bank account or a linked credit card as a funding source, and choose how you want your recipient to receive their funds: via ACH, wire transfer, or check. Bluevine customers also receive 200 printed checks to use when a paper payment is needed.

Debit Mastercard

Your Bluevine Business Debit Mastercard helps you keep purchases made for your business separate from those made for personal use. You can also use your debit Mastercard to make fee-free withdrawals at partnered MoneyPass® network ATMs located at more than 38,000 branches. In many cases, withdrawals at non-network ATMs are still processed and only incur a small fee (determined by the ATM owner).

Customer Service

Bluevine offers a live support customer care line so you can quickly get help with your account when needed. If anything happens to your debit card, you can lock it in a matter of minutes. Support is also available via email or through Bluevine’s resource center.

- Phone Number – 1.888.216.9619

Linked Accounts

You can link third-party accounts and credit or debit cards to your Bluevine account. You can also receive incoming wire transfers for free, and send outgoing wire transfers for only $15. You can use linked credit cards to pay bills or vendors, with only a 2.9% fee.

Other Bluevine Features and Benefits

Revolving Line of Credit

Bluevine also provides a revolving line of credit to business banking clients who meet specific qualifications. You’ll need to have been in business for three years or longer, have a FICO score at or above 625, and show regular revenues above $40,000 a month. Approval for a line of credit typically takes less than five minutes.

Your line of credit can range from $5,000 to $250,000 and you can draw against it at any time by requesting funds through your online dashboard. Funds will typically arrive in your account in hours, and you can repay them on a fixed weekly or monthly schedule spanning six to 12 months.

There are no fees to open or maintain a line of credit with Bluevine. Your interest rate will vary depending on your business and you’ll never need to submit prepayment fees or account closure fees. As you pay back each draw, your line of credit automatically replenishes for future use as needed.

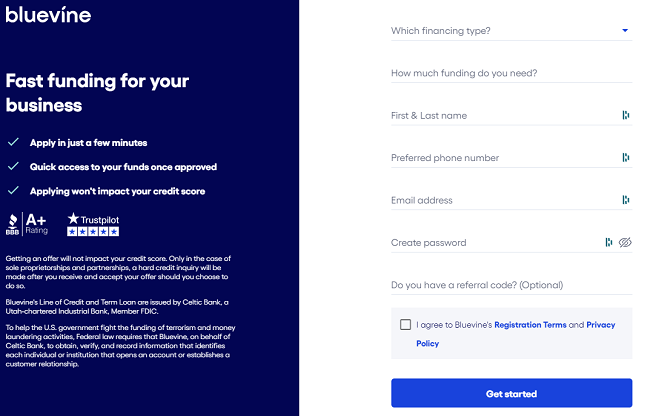

How to Sign Up with Bluevine

To be eligible for a Bluevine account, you must be:

- The owner of a small business

- At least 18 years old

- A U.S. citizen or resident (with a verifiable U.S. address)

Your business cannot be in any of the following industries:

- Adult Entertainment

- Gambling

- Weapons and Firearms

- Illegal Substances

To apply for Bluevine, you need to complete two steps:

- Provide your name, address, date of birth, social security number, and other personally identifying information, including a copy of valid photo ID

- Provide information about your business, including your business address, tax ID number, and last three months of banking statements

If you plan to apply for Bluevine’s line of credit, you’ll also need to provide:

- Information about your business

- A read-only connection to your bank account

Bluevine Pros and Cons

Pros

- Account linking – You can link your other financial accounts for sending and receiving money.

- Easy vendor payments – Pay vendors and bills via ACH, wire transfer, or check, including paper checks.

- Respectable APY – Earn % interest on balances FDIC-insured (up to $250,000).

- No fees – Pay no fees for incoming wires, ACH, in-network ATMs, or monthly account maintenance.

- Streamlined access – Gain web and mobile access to your account, and live customer support via email or phone.

Cons

- Repayment terms are short – Short repayment terms that require large payments on a weekly or monthly basis for line-of-credit advances.

- Some services are not available in all states – Line of credit is not available in North Dakota, South Dakota, or Nevada.

- Personal guarantee requirement – A requirement of personal guarantee (ties to both your business’ tax ID and your social security number).

Bluevine Alternatives

Novo

Novo is not just a business bank account, but a business toolbox. You can connect your account with all of the tools you use most, including TransferWise, Slack, Zapier, Stripe, Xero, and QuickBooks. You can also connect your Bluevine account to your other bank accounts to readily transfer money back and forth.

The Novo business debit card works to make purchases or withdrawals in many countries worldwide, and it refunds all ATM fees. You can make payments, send money, and pay bills from the mobile interface in real time. A Novo account also comes with $5500 worth of perks in business tools and apps.

Lili

Lili is a bank designed for freelancers. It has a heavy focus on its mobile experience, making it perfect for freelancers who want to manage their money while on the go.

The bank account comes with no minimum balance and no monthly fees. There also are no fees for things like overdrafts, making it one of the cheapest and easiest ways to bank. You can easily manage your money through the Lili app and you maintain easy access to cash with more than 30,000 fee-free ATMs around the country.

There are also perks specifically for freelancers, like the option to set aside a portion of your income to pay taxes. Lili will also track your debit card purchases and categorize them for you, making it easier to take deductions, and reducing your tax bill.

NorthOne

NorthOne is a bank for small businesses and freelancers. Newcomers can open an account in three minutes to unlock benefits like mobile check deposits, faster payments, and remote banking.

Through its versatile app, customers can do payroll, settle bills, and move money around in just a few taps. Debit card holders can withdraw cash for free through ATMs and NorthOne automatically categorizes purchases seconds after the transaction has gone through to make bookkeeping easy.

Frequently Asked Questions (FAQ)

Does the Bluevine Visa Debit Card include a network of no-fee ATMs?

Yes, Bluevine partners with the MoneyPass® network, which means transactions are free at over 38,000 ATMs. The Bluevine Business Mastercard will also work at other ATMs, and you’ll only pay the owner ATM fee.

Does Bluevine have a desktop version?

Yes, Bluevine has a desktop web-based site and a mobile app version so you can access your account anytime from anywhere on any connected device.

How can I pay vendors who don’t accept credit cards?

With Bluevine Payments, you can use your credit card or ACH to fund payment, and Bluevine’s third-party payments partner will mail a check to the vendor’s address. ACH is free, or you can use your credit card and incur only a 2.9% fee.

What happens if a customer doesn’t pay?

You’ll have to settle the invoice with Bluevine if a customer skips out on their invoice. Bluevine will alert you to different ways to pay, and you’ll have the option of an installment program.

Do I have to pay fees to open, maintain, or close a line of credit?

No, there are no such fees associated with your line of credit. You also won’t have any prepayment fees, so you can pay off your line of credit early if needed.

What’s the difference between a line of credit and a merchant cash advance?

A merchant cash advance requires reapplication and reapproval each time you need an advance. With Bluevine, once your line of credit is approved, you can request a draw at any time, and funds can reach your account in mere hours.

Is Bluevine available internationally?

No, Bluevine is currently only available in the U.S. You can use your Business Debit Mastercard internationally.

Bottom Line: Is Bluevine the Right Choice for You?

Bluevine can be the perfect solution for small business owners looking for ways to expand their company and stabilize their cash flow. You’ll be able to access all of the benefits of a traditional bank account with fewer fees and no need to visit a physical bank branch. Use your phone to complete every transaction with maximum speed and efficiency.

The ability to fund outstanding invoices can resolve nagging cash flow issues and enable you to pay employees and vendors on time and in full. You can transfer funds and make payments directly from the app. You’ll also be empowered to schedule one-time or recurring payments days or months in advance.

If you’re in the middle of an expansion and need a working capital infusion, a revolving line of credit will help you scale efficiently. You can pay down your draw rapidly or take out another one as needed. The interest rate on your line-of-credit draws is typically less than the fees charged for a merchant cash advance or a traditional business loan.

Bluevine Business Checking Account

Summary

Bluevine has everything a small business needs in a checking account. No fees, solid interest rates, and multiple account offerings.