Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

A checking account is like a financial clearinghouse. It serves as the center of your financial life. Any money you make arrives in your checking account, and all the money you spend comes from it.

Just like people, businesses need access to banking services like checking accounts. Business owners can use business checking accounts to keep their personal and company finances separate, and many banks offer specialized, business-focused features in their business checking accounts.

Chase is a large bank that offers both personal and business banking services. Its best business checking account is called Chase Business Complete Checking®.

Chase Business Complete Checking Features

These are some of the top features of the Chase Business Complete Checking Account.

$300 Welcome Bonus

When you open a new Chase Business Complete Checking account, you can earn a $300 bonus by meeting a few qualifying activities.

- Deposit $2,000 in new funds into your account within 30 days of offer enrollment.

- Maintain at least a daily balance of $2,000 for 60 days.

- Complete five qualifying transactions within 90 days of offer enrollment.

For any small business, those activities should be rather simple. When completed, your bonus will be deposited into your account within 15 days. Offer expires 10/17/2024.

Online Bill Payment

Businesses, just like people, have bills to pay. Whether paying your employees or invoices submitted by suppliers, your business will have to send money to other people from time to time.

Chase Business Complete Checking offers multiple options for both sending and receiving payments. Chase’s online bill payment service has a few business-focused features, making it easy to track your payments in progress and your bills so you can be sure never to miss a due date.

The company also offers an online bill payment guarantee. Chase guarantees that your bill payments will always arrive by the time they are scheduled to arrive. If an error by Chase causes you to miss a due date and incur a fee, Chase will pay the late fee for you.

Business Savings and Lending Services

One of the benefits of banking with Chase is that it is a large, well-known brand that offers various banking services. If you like your experience with Chase Business Complete Checking, the odds are that you won’t have to find another bank if you need other services, like credit cards or loans.

Related: Best Small Business Loans

Business credit cards are a great way for business owners to finance smaller purchases over the short term and give employees who need to make business purchases a way to do so without complicated reimbursement arrangements. Chase also has generous rewards programs if you use its business credit cards.

Chase also offers loans and lines of credit to companies large and small, giving you a way to finance an expansion of your company or the money you need to tackle other projects.

Related: Best Small Business Credit Cards

Point of Sale Systems

Any successful business needs a way to get paid for the goods and services it provides. Even if you have the best products in the world, you can’t make money if people can’t pay you.

Chase offers point-of-sale solutions that you can use with any of its business checking accounts. The Chase QuickAccept tool lets you accept both credit and debit card payments with an easy-to-understand fee structure and same-day deposits of the payments you receive.

You can install the app on your phone or tablet, so you don’t have to buy additional equipment to accept payments for your business.

Chase Business Complete Checking Pricing and Fees

Chase Business Complete Checking charges a $15 monthly fee, but that fee can be waived by meeting just one of the following criteria:

- $2,000 minimum daily balance

- $2,000 in net purchases on your Chase Ink® Business Card(s)

- $2,000 in deposits from Chase QuickAccept® or other eligible Chase Payment Solutions transactions

- Link a Chase Private Client Checking℠ account.

- Provide qualifying proof of military status.

Some of Chase’s other account services also involve fees. For QuickAccept transactions, you’ll pay 3.5% + $0.10 per key entry transaction and 2.6% + $0.10 for card reader transactions.

You’ll also pay $0.40 per transaction (deposit, withdrawal, ACH transfer, etc.) if you make in excess of each account’s free transaction limit.

Signing Up

Opening a business checking account with Chase is like opening an account with any other bank minus a minor detail. First, you will need to input your email address to be mailed a special offer code (which includes the $300 bonus if you qualify)

You’ll be asked for basic information about yourself and your business during the application process.

You’ll also have to link another bank account to fund your business account with an online transfer. Chase makes this process easy if you have an existing personal bank account.

You can also open the account in person at a branch by bringing in the coupon code. The application process will be similar in person, on your desktop or phone.

Learn More: How to Open a Business Bank Account

Chase Mobile App, Security, and Support

Chase Mobile App

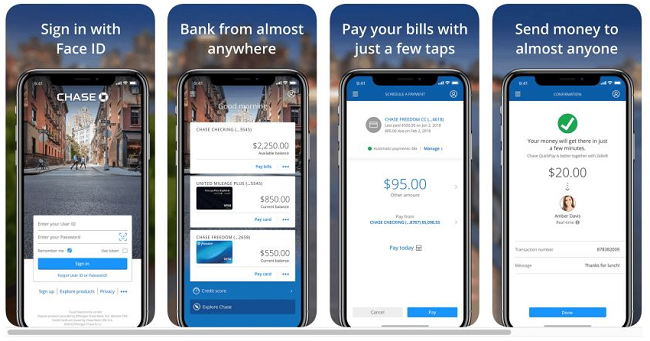

Chase offers one powerful mobile app that you can use to manage all of your Chase accounts in one place. This includes business and personal bank accounts, credit cards, and loans.

The app is easy to use and has a sleek interface. You can accomplish almost any task you need to through the app, including transferring money between accounts, paying bills, setting up automatic transfers, and accepting card payments from customers.

Related: Best Mobile Banking Apps

Security

Security is a top concern when it comes to your money, so you want to know that the money you keep in your Chase business checking account will be safe.

Chase uses state-of-the-art encryption and internet security tools to protect your personal information and money. The same is true for its mobile application. You can also set up multi-factor authentication for additional account security.

Related: Is Online Banking Safe?

Customer Service

Chase offers many ways to contact customer service when you need help. Some options are available 24/7, while others have more limited hours, but there’s always a way to get the help you need.

The simplest way to get help is to call the company’s support line. Assistance is available 24/7.

- 1-877-242-7372

If you’d rather not chat with someone over the phone, you can send a secure message through your account portal anytime or night. Chat support through the company’s Twitter account is also available from 7 AM—11 PM Eastern on weekdays and 10 AM—7 PM Eastern on weekends.

Chase also accepts support requests through the mail, and of course, you can visit a branch to speak to a banker anytime a branch is open.

Related: Best ATM Locator Apps

Chase Business Complete Checking Pros and Cons

Pros

- Nice welcome bonus – $300 is a very solid welcome offer

- Widely available customer support—Customer support is available 24/7 by phone, and you can also speak with someone in person at a branch or online through social media.

- Multiple account types available — Chase offers three different checking accounts to suit the size of your business.

- Banking services — Full suite of banking services, including lending and savings.

- Large network — National network of branches and ATMs.

Cons

- Monthly fee — Avoidable, but not ideal for very small businesses

- Transactions — Some limits on transactions.

- Extra perks — Lack of features and perks, like integrations with bookkeeping tools or discounts on business services.

Chase Business Complete Checking Alternatives

Novo

Novo offers an online business checking account for business owners who do most of their business online.

As a fintech company, Novo doesn’t offer an option for depositing cash. However, it offers many perks and features that can benefit online businesses. For example, account holders can get discounts on services like Google Cloud, Quickbooks, HubSpot, and Google Ads.

Novo also integrates with tools like Slack, Shopify, and Stripe to make it easier for you and your team to keep your business running smoothly.

Best of all, Novo doesn’t charge any hidden or monthly fees. Once you make the $50 opening deposit, there are no minimum balance requirements and few fees to worry about.

- Minimum balance: None

- APY: None

- Transaction Limits: 20 check deposits per month

- Monthly Fee: None

Lili Basic

If you’re a freelancer who doesn’t need all of the services that Chase provides, Lili might be a good choice for you. Lili is a mobile-focused bank that was designed specifically for freelancers.

There are no minimum balance requirements to worry about and the account is practically fee-free. There is no monthly fee and you don’t even have to worry about overdraft fees.

You’ll maintain easy access to your cash with a debit card that you can use anywhere and a network of more than 30,000 fee-free ATMs nationwide.

Lili can also help make paying your taxes easier by automatically setting some of your income aside to make estimated tax payments. Lili also tracks your debit card spend, making it easier to claim business expenses on your tax return.

- Minimum balance: None

- APY: None

- Transaction Limits: $5,000 per day for debit card spending

- Monthly Fee: None

Bluevine

Bluevine offers an online checking account and lending services, making it a solid choice for companies that need inexpensive banking services, but who want the option to borrow money if they’re looking to expand.

Like Novo, Bluevine lets businesses deposit cash. The deposits happen through a partnership with GreenDot, so there is a $4.95 fee for each deposit. This can add up quickly if you make frequent deposits, but the good news is that there are no monthly maintenance fees to worry about.

Another perk of the account is that you can earn a solid interest rate on balances up to $250,000 – Eligibility requirements apply. The interest can add up if your company has a large cash cushion.

- Minimum balance: None

- APY: %

- Transaction Limits: None

- Monthly Fee: None

Frequently Asked Questions (FAQ)

Does Chase have a fee-free business checking account?

No, Chase does not have a completely free business checking account. The closest account it offers is the Chase Business Complete Checking account, which has a $15 monthly fee but offers many ways to have the fee waived.

Who can open a business checking account?

Anyone with a business or planning to start a business can open a business checking account, and doing so has many benefits. Chase will allow people with officially organized businesses and sole proprietors without special business documents to open accounts.

Can I use a personal bank account for my business?

Using your bank account for your business is possible, but it isn’t a good idea. A dedicated business bank account keeps your personal and business finances separate, making it much easier to keep track of your business’s money. In some cases, it’s required. For example, owners of limited liability companies can lose their liability protections if they mix their business and personal funds.

Business bank accounts also come with features designed to help business owners manage their company’s finances. Personal bank accounts focus on individuals’ financial needs, meaning the features will not be as applicable to a small business.

Is Chase Business Complete Checking Right for You?

The greatest drawback of Chase Business Complete Checking is the $15 monthly fee. While the fee is relatively easy to avoid, it’s still expensive compared to the many free options.

I’ve used Chase’s personal and business credit cards for years now, and I’ve had nothing but good experiences with them. I also banked with the company briefly and had a lovely experience.

If you want a business checking account that works and can grow with your business, Chase Business Complete Checking is a great choice. The account’s fee structure is reasonable, the $300 welcome offer is a great start, and the monthly maintenance charge is easy to avoid.

Opening the account also gives you access to many other services your business could use, like credit cards and loans, making it easy to recommend trying the account.

Most businesses will be best served by Chase Business Complete Checking and for those who take in a lot of cash, it’s one of the best Business Checking accounts you can own.

Chase Business Complete Checking®

Summary

Chase Business Complete Checking has an excellent up-front offer and tremendous features for everyday business banking. Be careful of its monthly fee.