Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Wally GPT bills itself as “The World’s 1st AI-Powered Personal Finance App.” Is Wally simply cashing in on AI mania? Does AI even make for a better personal finance app? If so, what are the benefits? We want to answer those questions in this Wally Budget App Review 2024.

What is the Wally Budget App?

Wally goes beyond basic budgeting and instead acts as a financial resource. This is perhaps best explained by the service’s mission statement:

“My mission is to help you level up your life. Whether personal or professional, you have goals, and I’m here to help you accomplish them efficiently and excellently. Consider me your assistant, mentor, life coach, and companion.”

Notice the first word in the mission statement is my. Wally functions like a robotic person, referring to itself in the first person. It also refers to a team working in the background to help it do its job.

What exactly is its job? It seems unlimited. If it’s a chore that can be accomplished on the Internet, Wally can help. It’s not designed to provide direct investment or financial advice. Still, much like ChatGPT, its purpose is to enable you to quickly and easily cut through the clutter and access only the specific information you’re looking for on the web. That information will be explained in the next section.

The Wally budgeting app has the following third-party and user ratings:

- Better Business Bureau: Not rated

- Trustpilot: Not rated

- The App Store: 3.2 out of 5 stars based on 31 reviews

- Google Play: 2.1 out of 5 stars based on 177 reviews

How Wally Works

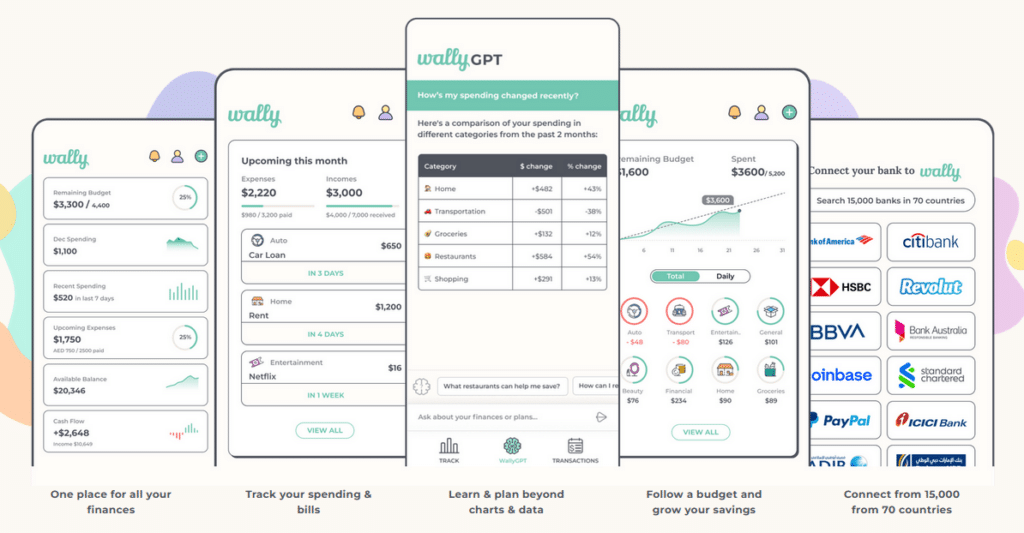

Wally is a fully automated service enabling you to connect with over 15,000 banks in 70 countries. It will automatically track income, spending, pending bills, budgets, and just about everything financial. It can also provide your net worth in any covered currency. Closer to home, it can show you your upcoming bills and notify you when they are due to help you avoid late fees.

The app is AI-powered, enabling you to talk to “WallyGPT.” You’ll be able to get financial information to help you with your finances, especially learning about money and investing.

Wally works on a system called queries. A query represents a unit of work Wally must perform either in answering a question or automating your work. The free version limits you to no more than 51 queries per day, but the premium versions can go as high as 25,000.

For example, you can ask questions like “How much money am I spending on entertainment?” or “How can I build up my emergency fund?” Answers will be provided within seconds. You can even ask Wally questions that will help you gain better insight into more complicated financial topics, like investing, insurance, or loan-versus-credit lines.

Wally won’t recommend specific investments, but it can provide information on some of the top stocks and funds available. It can even help you to find the best deals on car insurance, credit cards, loans, and investment services.

Wally Budget App Features & Benefits

Wally provides the following features, showing that this app does much more than basic budgeting. Exactly which features you can access will depend on your chosen plan (see Pricing below). Please note that some of these features are currently available in beta only.

- Chat with any website. This feature provides a quick summary of an article on the web. It highlights the most important points in the article, and when you ask Wally a specific question about the page, you’ll get an answer. This feature can save you substantial time reading articles and other web-based documents.

- Gmail auto-draft (currently in beta). Wally is rolling out this feature to provide draft responses to your emails. It will even do so using your “voice”.

- Gmail, TikTok, Facebook, and Slack Companions (currently in beta). It helps you compose emails, including sales pitches. Wally will offer suggestions and automatically suggest the required context.

- Gmail, Linked In, and X (Twitter) Companions (currently in beta). Use the ChatGPT writer to assist you in writing posts and responses on all three platforms. If you regularly post on social media, this feature will help you deal with writer’s block.

- Google Insights. Wally will provide answers from Google searches without the need for you to visit multiple web pages to sift for answers.

The Wally app offers plenty of other features. For example, It can summarize PDF, DOC, and PPT files in seconds. Wally also provides YouTube and Vimeo video summaries so you can focus on the highlights of the content it presents.

Much like AI itself, Wally is a work in progress. Expect many more new features in the future.

Wally Mobile App & Security

Wally can be downloaded from The App Store for iOS devices and Google Play for Android devices. It is also available on the web through Chrome.

Transmission is encrypted end-to-end when you sync your financial accounts to the Wally app. The app is also PCI compliant, ISO 27001 certified, and GDPR compliant.

Wally does not collect or store your credit card information, username, or password. It cannot make transfers or payments or charge additional charges to your card. In addition, Wally does not share, sell, or rent your data.

Customer Service

To contact Wally, you must use the email [email protected]. There is no phone contact offered. Wally is available on major social media, including Facebook, Instagram, Linked In, TikTok, Twitter/X, and YouTube.

Wally Pricing

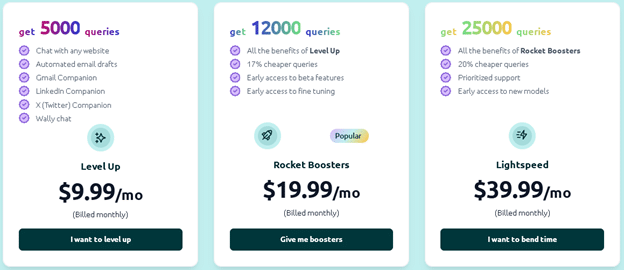

Wally is free to download either on Google Play or The App Store. If you use the free version, you’ll be limited to no more than 51 queries per day. However, they do offer three premium plans as follows:

If you sign up for an annual plan, you can save 20%. For example, Level Up will be $7.99 monthly, Rocket Boosters will be $15.99 monthly, and Lightspeed will be $31.99 monthly.

Sign-on bonus: None indicated at this time.

How to Sign Up with Wally Budget App

You can sign up for Wally using the desktop edition (Chrome), or through the mobile app with either an iOS or Android device. You’ll need to create a username and password, and once you establish your account, you will begin linking any financial accounts you want to the app.

No credit or debit card will be required unless you sign up for one of the three premium plans.

Wally App Pros and Cons

Pros

- Wally takes advantage of the power of AI to assist you in managing your finances.

- Provides a user-friendly question-and-answer format so you can access the information you seek quickly and easily.

- Links with more than 15,000 financial accounts in 70 countries.

- Though Wally offers three premium plans, you can have unlimited access to the service free of charge if you choose not to use one.

Cons

- Since Wally is AI-based, it is somewhat unconventional in the personal finance app space. It may take some getting used to.

- During our review, we could not access the Wally app on The App Store. It indicated only “connecting to Apple Music” (which never happened, either).

- The app has low ratings from iOS and Android users and no ratings from Trustpilot or the Better Business Bureau.

- Does not offer customer service by phone.

Wally Budget App Alternatives

Buxfer

If you’re looking for a more comprehensive budgeting app, check out Buxfer. It offers basic budgeting, forecasting, investment tracking, and retirement planning. If you have foreign accounts or numerous international transactions, you’ll appreciate that Buxfer is available in over 100 currencies and more than 150 countries.

Buxfer is available in three different plans, depending on the level of financial tracking you need. The most basic is the Plus plan at $4.99 or $3.99 monthly if you pay annually. Next up is the Pro plan, at $5.99 per month or $4.99 per month for the annual plan. Finally, the top-of-the-line Prime plan is available for $11.99 per month or $9.99 per month for the annual plan.

YNAB (You Need A Budget)

YNAB is one of the most popular budgeting apps in the space. It uses a unique “Four Rule” approach to budgeting. The rules work like this: 1) each dollar in your budget is assigned an expense category, 2) you will anticipate large, occasional expenses, 3) you’ll build flexibility into your budget, and 4) you’ll “age your money”. With the last rule, you’ll gradually move toward paying this month’s bills with last month’s money. That puts an end to the paycheck-to-paycheck conundrum so many are struggling with.

YNAB is available with a monthly fee of $14.99 or an annual payment of $99 (the equivalent of $8.25 per month).

Empower

Though it offers limited budgeting capabilities, Empower is a financial account aggregator where you can link all your accounts on the free financial dashboard. You can add bank accounts, investment accounts, loans, and credit cards. The dashboard includes valuable financial tools, like Investment Checkups and the Retirement Planner.

Empower also offers the Empower Personal Cash account, which currently pays 4.70% APY on balances up to $5 million with no fees. It also offers investment accounts, managed portfolios, and wealth management services, each with its specific pricing schedule.

Frequently Asked Questions (FAQ)

Is Wally GPT free?

Wally can be used free of charge but offers only limited queries (questions and tasks). You must sign up for one of the three premium plans to take advantage of the enhanced features and benefits.

Is it safe to link bank accounts to Wally?

The app uses standard industry protocols to protect your information, including encryption of data transmission. This minimizes the likelihood unintended third parties will access the information.

What are the disadvantages of Wally?

As an AI-based product, Wally may take some time to get used to. It

doesn’t work the way standard budgeting and financial apps do. Instead, it’s heavily driven by a question-and-answer format. While it does provide information, it does not offer financial advice.

You should also be aware that this app offers no phone-based customer service.

Should You Sign Up for the Wally Budget App?

Wally is a unique financial app that emphasizes AI. While it’s clear that AI has many advantages regarding personal finance, it is a relatively new endeavor. In addition, this app has many moving parts. If you’re looking for a financial app that focuses primarily on a single function, like budgeting or investing, you may want to look into one of the alternatives listed above.

We also recommend scanning personal reviews on Google Play and The App Store. Those reviews may reveal whether or not you are interested in pursuing this cutting-edge product. Otherwise, you can dive in and poke around for yourself; after all, Wally is free to download and use, so you have nothing to lose.

Wally GPT

Summary

Wally is the first AI app that can focus on building your financial portfolio. It has three reasonably priced subscription levels with up to 25,000 monthly queries.