Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Debt is a major problem for many Americans. For some, their debt isn’t a problem because it is so-called good debt, such as a mortgage. But for many, their debt is in the form of credit card balances, payday loans, or other expensive forms of debt.

When you’re in debt, it can feel like an impossible escape. Even when you make your monthly payments, high-interest rates can make you feel like not much progress is being made. There are apps and tools you can use to help make repaying debt a bit easier, giving you a better chance to get back on your feet financially. Here are five of our favorite debt repayment tools.

Overview of the Best Debt Repayment Tools and Apps

| Brand | Best for |

|---|---|

| Tally | People who want to consolidate their debts |

| Mint | People who want an app that can help with their budget, not just debt |

| Undebt.it | People who want a free tool |

| ZilchWorks | People who want a secure, offline program |

| Debt Manager | People who want a mobile-focused option |

Tally

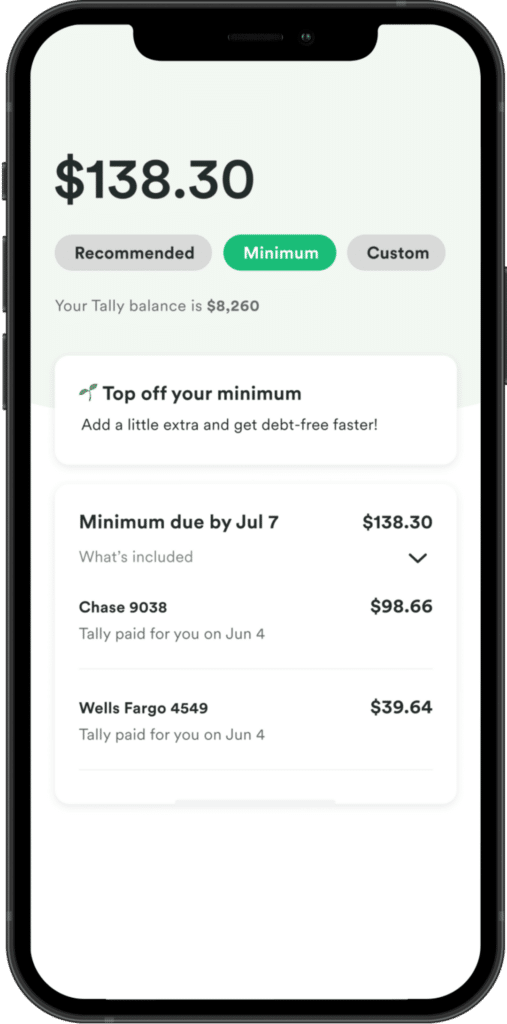

Tally is an app designed specifically for people who are having trouble paying off credit card debt.

What sets Tally apart from the competition is that it helps you consolidate your existing credit card debt into a single monthly payment. When you sign up for Tally, you’ll enter your debt information. Based on your creditworthiness and the amount you owe each month, Tally may give you a line of credit.

If you qualify, Tally will handle paying your credit card bills for you. All you have to do is make a single payment to Tally each month. Tally does charge interest on the line of credit but aims to make the rate lower than the rates charged by your credit cards. There are no origination fees or maintenance fees.

Other than the cost of its line of credit, Tally is free to use, however, you can only take advantage of its service if you’re able to qualify for its line of credit. According to Tally, you’ll need a minimum FICO score of 660 to qualify.

If you want access to lower interest rates and a higher line of credit, you can also choose to pay for a Tally+ membership for $25/month. This fee is paid from your line of credit and you have to make your payments on time to get the best interest rates.

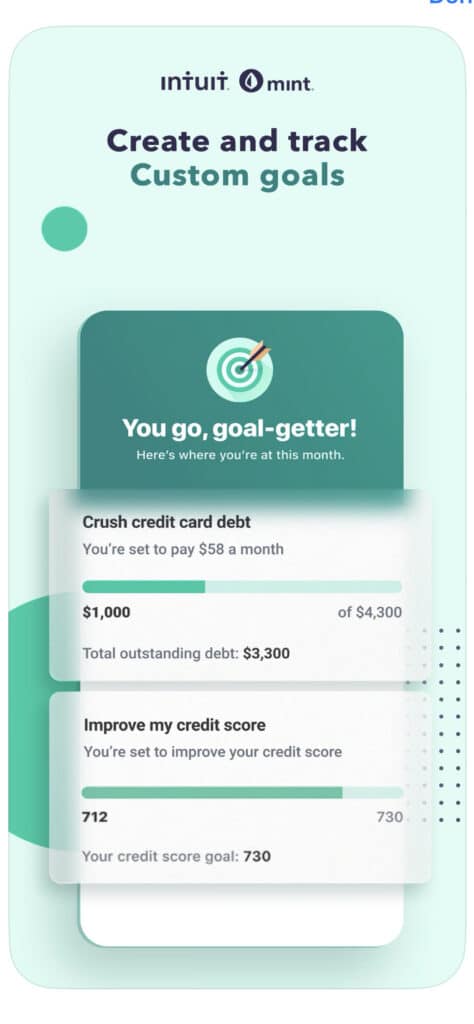

Mint

Mint isn’t so much a debt repayment tool as it is a tool to help you keep track of all of your financial accounts in one place.

Mint connects with your bank, credit card, and investment accounts, automatically importing your balances and transaction information.

You can use Mint to build a budget, telling it how much you want to spend on each category, such as groceries, entertainment, and utility bills. As you spend money, Mint automatically categorizes your transactions and keeps track of how well you’re sticking to your budget.

Building a budget can help you repay your debt more quickly by making you more mindful of how you spend your money. If you know that you have $3,000 to spend each month, you’ll want to build a budget that involves spending less than that. Then you can put any extra cash toward debt payments.

For every dollar you can shrink your budget, you get an extra dollar that you can put toward repaying your debt ahead of schedule.

Mint does offer some useful tools to make managing your debt easier. You can use the Goals feature to track your debt payoff progress and savings goals.

Mint can also keep track of due dates so you can make sure you don’t miss any payments. The app also offers regular credit score updates so you can watch your score improve as your pay down your balances. Mint is completely free. There is no premium service to subscribe to.

Related: Best Mint Alternatives

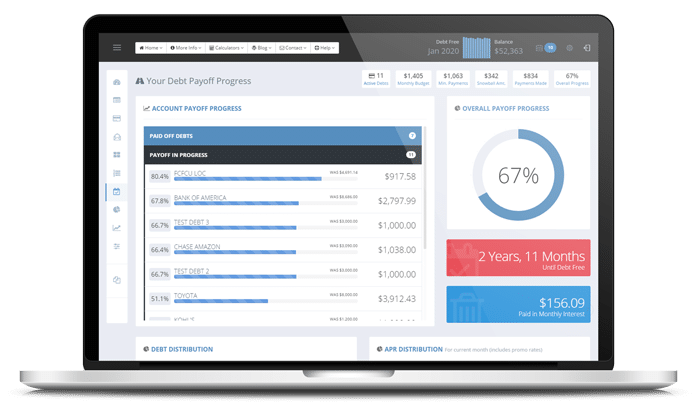

Undebt.it

Undebt.it is a free online debt calculator. After you create an account, you’ll see a dashboard. Here, you’ll enter all of your different debt accounts, including how much you owe, the monthly payment, the interest rate, and the credit limit of the account.

From your dashboard, you can view all of your debt accounts in one place. The dashboard shows you how much you owe, what your next payment is, and when you’ll pay off each debt.

The site offers a lot of valuable tools and visualizations that you can use to get a better handle on your debt situation. You can see a graph of your balances over time and how adding an extra $25 can speed up your repayment. If you’re curious about how different payment strategies affect your repayment schedule and the total amount paid, the site can help with that too.

You can also use Undebt.it to get an idea of how repaying your debts will improve your credit score by helping you build a payment history and reduce your overall debt.

Undebt.it also offers a paid membership plan called Undebit.it+ offering more features including bill management and custom debt payoff methods for $12/year. You can also try Undebit.it+ free for 30 days.

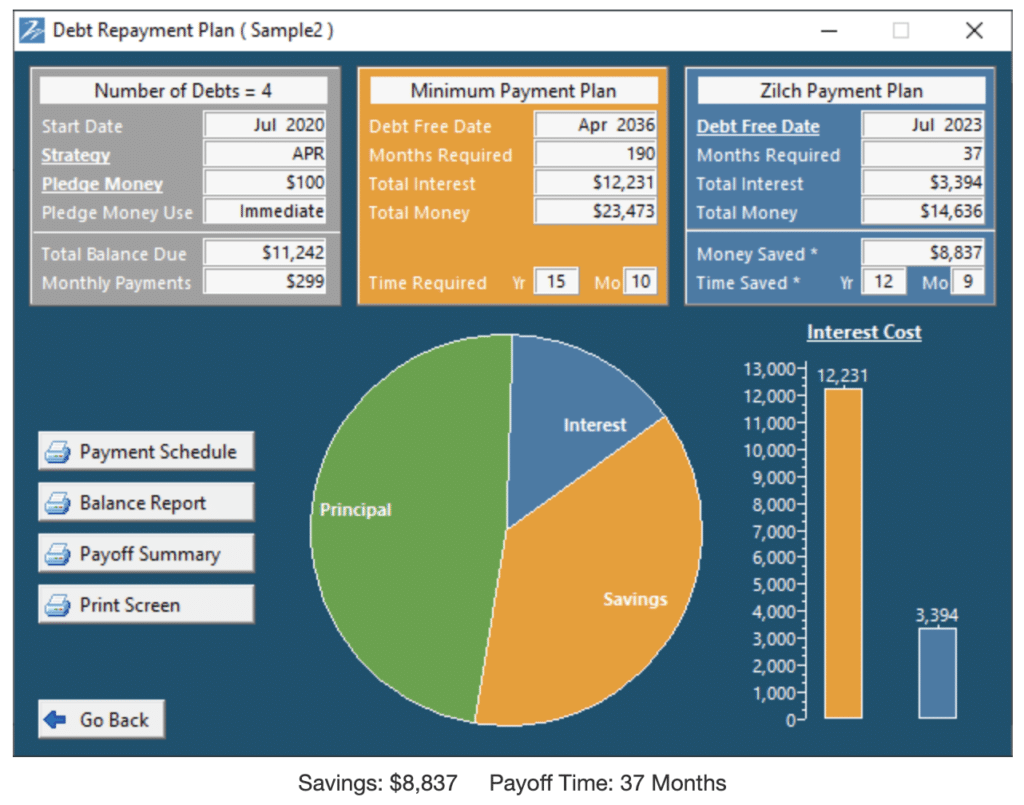

ZilchWorks

ZilchWorks is a downloadable program designed to help you get out of debt quickly. Once you download the tool and enter your budget and debt information, ZilchWorks can design a personalized payment plan. The company’s website advertises that it can help you create a plan in as little as 10 minutes.

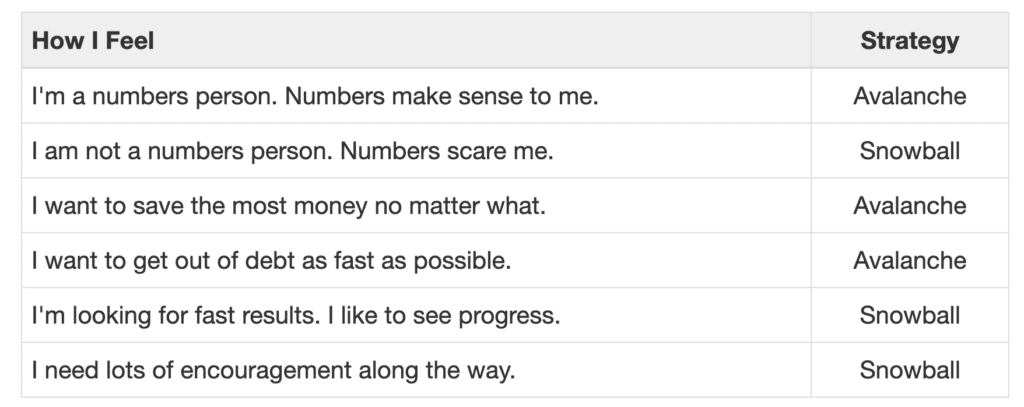

ZilchWorks aims to help its customers pay off their debts in as little as two years. It can also help you save money because its plans take into account interest charges and can help you pay down the most expensive debts first, also known as the debt avalanche method. You can choose between the debt avalanche or debt snowball method. Debt avalanche focuses on paying off high-interest debt first and the debt snowball knocks out the lowest-balance debts first. Here’s how ZilchWorks helps you find out which method may be best for you:

If you’re security conscious, ZilchWorks is one of the better tools on the market. Unlike many of its competitors, ZilchWorks is a downloadable program rather than a web-based app. Once you download the tool, you can work with it completely offline. That means that your data won’t be hosted on an internet server where it could get exposed to hackers.

It costs $39.95 to unlock the standard version of the software.

Debt Manager

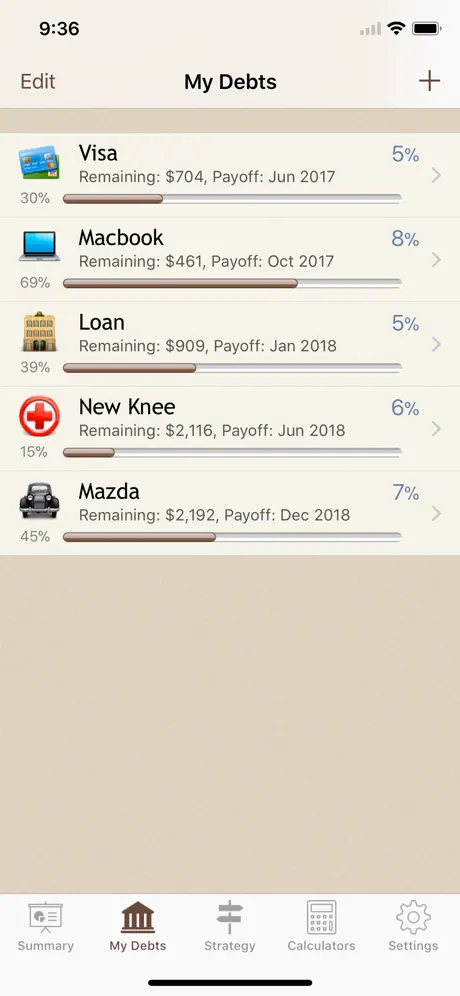

Debt Manager is a mobile app that can help you understand and get control of your debt.

Unlike some of the other apps on this list, Debt Manager doesn’t automate making payments or set aside money for you. Instead, Debt Manager helps you keep track of your debts, visualize their balances, and see how those balances change over time.

When you open the app, you’ll enter your debt information, including balances, interest rates, and monthly payments. The app will then show you your payment schedule and how long it will take to repay your debts.

Add extra payments, and Debt Manager will update its calculations to reflect the additional payments. Once you pay off one loan, it will automatically put the money you were paying toward that loan toward another loan.

Debt Manager lets you choose from the same two debt payment strategies mentioned above, the debt avalanche or debt snowball.

Debt Manager is quite cheap, with a one-time cost of $0.99.

How We Came Up with This List

We built this list using a few criteria.

First, we looked at whether the app was truly helpful. Lots of apps claim to help people make more money or get out of debt, but not all of them work. We looked for useful, easy-to-navigate tools.

We also looked at the cost of the tool. When you’re in debt, you don’t want to waste money on expensive apps and tools that may or may not help. The programs here are either free or reasonably priced based on how much they can help you save.

FAQs

Here are some of the most frequently asked questions about debt repayment apps.

How can an app help me repay debt?

Each app on this list uses a different method to help you repay your debt. Apps like Tally try to make paying your debt easier by automating the process or sending extra payments for you. Debt can be stressful, so taking some of the mental load away can make repaying debt easier.

Other apps aim to help you visualize your debt, keep track of it, and see how your payments affect your debt. Understanding how debt and interest work can be difficult and these apps try to make it easier. It can be encouraging to see how much even small additional payments can save you in the long run, which means these apps can help encourage you to pay down your debt more quickly.

Is consolidating debt a good idea?

One popular strategy for repaying debts is consolidating your loans into one. Consolidating your debt might be a good idea if you have lots of different loans and have trouble managing multiple monthly payments. Having a single loan is much easier to handle and can make the process simpler. Sometimes, you can also reduce the interest rate of your debt by consolidating it.

Credit cards, for example, are notorious for charging high rates of interest. If you can consolidate a few credit card balances into a lower-interest debt, you can save a lot of money in the long run. The drawback of consolidating debt is that it sometimes comes with upfront costs, like origination fees, and you need to have good credit to qualify for a consolidation loan.

I have multiple debts, which one should I pay first?

If you have more than one debt, it can be hard to choose which debt to put extra payments toward. There are two main strategies that you can use. The debt avalanche focuses on paying the higher-interest debt first. This will save you the most money in the long run because it will reduce the amount of interest that accrues.

The debt snowball focuses on paying off your smallest balance debts first. If your budget is tight, this can free up some cash because once you pay off a loan, you’ll have one less minimum payment to make each month. It can also feel good to pay off a loan, so this method helps you get small victories and work your way up to larger ones. Both strategies have pros and cons, so it’s up to you to choose the one that works for you.

Final Thoughts

Dealing with debt can be stressful and difficult. If you have a lot of debt, it can be hard to see a way out of your situation.

These tools can help you get a handle on your debt and build a repayment plan. They can also help you automate the process, eliminate stress, and show you how quickly you can get rid of your debt.