Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

In this review, we take a look at the AAA ProtectMyID service. We’ll cover its features, how it works, the cost, and how it stacks up to other identity protection tools and services.

Monitoring your credit for fraudulent activity can be exhausting. You have the choice to either check all three bureaus regularly for new inquiries, unfamiliar accounts, and collections reports for accounts that aren’t yours or freeze your credit across the bureaus and hope for the best. Well, there’s actually another option: sign up for an identity theft monitoring service and rely on the alerts that they will send you.

If you’re a AAA member, you’re in luck. The company, known for its roadside assistance and excellent discounts, now offers its members a free credit monitoring service called ProtectMyID, provided by Experian.

Considering that the service is free, it’s easy to add it to your credit-protection arsenal. But does AAA’s identity theft service do a better job than the monitoring services you already have, and is it really free?

Let’s take a look at what members will get with ProtectMyID, and whether it’s worth the trouble to sign up.

What You Get

Initially, ProtectMyID was only offered to AAA members in a select number of states (Hawaii, California, New Mexico, and Texas). Now the service is available to members all across the country.

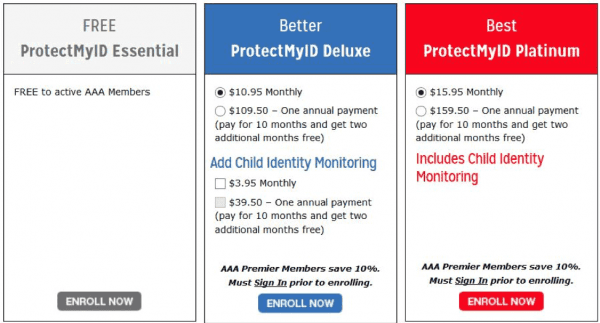

There are three options to choose from when signing up for ProtectMyID as a AAA member: Essential, Deluxe, and Platinum. The complimentary service is the Essential level, and won’t cost you a thing. To upgrade to Deluxe is $10.95 a month ($109.50 a year) and Platinum is $15.95 a month ($159.50 a year). You can also add child identity monitoring to the Deluxe level for $3.95 more a month–it cannot be added to the Essential level and is included for free with Platinum.

When you sign up for Essential monitoring, you’ll get a handful of features. Of course, keep in mind that this service is entirely free, so beggars can’t be choosers.

First off, your Essential monitoring will only include data from Experian. This is still beneficial, and most other free credit report/monitoring websites do the same (choosing one or two bureaus to pull data from), but it won’t give you a complete picture. If an inquiry were to be reported to either of the other two bureaus, you wouldn’t know about it, even though you’re having your identity monitored with ProtectMyID.

When you first enroll, you’ll be given your Experian credit report. Again, this will only cover accounts that were reported to Experian, but it is still nice to have. However, it will not include a credit score–for that, you’ll need to be Deluxe or Platinum level (at which point you’ll get your VantageScore 3.0).

With Essential monitoring, you’ll enjoy coverage like lost wallet protection. This means that if your wallet is lost or stolen, you’ll be able to cancel and replace all of your important cards (credit cards, insurance cards, etc.) with only one phone call. No more waiting on hold for each and every credit card company to cancel and order new cards–just give ProtectMyID a call and they’ll do all of the hard work for you.

You’ll also get fraud resolution support. If your identity is stolen, ProtectMyID will provide an agent that will guide you through the resolution process. They will offer step-by-step instructions for investigating the theft, as well as restoring your good name and clearing the fraudulent accounts.

Lastly, with Essential monitoring protection, AAA Premier Members will be covered with up to $10,000 in identity theft insurance. This money can be used to reimburse you for certain eligible expenses associated with ID theft. These include lost wages, legal fees, and even electronic fund transfers.

What You Don’t Get

We all know the saying, you get what you pay for. Well, with ProtectMyID, it holds true.

While this complimentary service makes a great addition to your arsenal, it’s just that: an addition. Their Essential level of protection is entirely too basic to be your go-to for identity theft monitoring, and you’ll still need to find (or keep) a number of other services in order to be truly protected in real time.

Here are just a few of the things you won’t get with AAA’s free monitoring (unless, of course, you want to pay a monthly fee to upgrade):

- Your credit score

- Dark web surveillance

- Real-time identity alerts

- Change of address alerts

- SSN monitoring

- Bank account and credit card takeovers

- Criminal bookings and court records monitoring

- Child identity monitoring

- Social media monitoring

- Payday loan monitoring

- Sex offender monitoring

- Positive credit activity alerts

- Credit limit and usage alerts

- Dormant credit card monitoring

You may have a monitoring service that already does these things, in which case, you’re likely covered. It’s always great to have an overlap or services (especially if it can be provided for free), but on its own, you’re lacking quite a bit with Essential coverage.

Is AAA’s Identity Theft Monitoring Worthwhile?

At the end of the day, it comes down to this: AAA is offering its members a free service that helps them check and monitor credit/identity-related activity. There’s only so much you can expect from the service, as it’s complimentary, but it is probably worth adding to your arsenal. After all, there’s no harm in doing so.

Whether you decide to upgrade to either the Deluxe or Platinum levels is up to you. It should be contingent on which of those services you need, and which you’re already getting from other credit monitoring subscriptions.

I wouldn’t feel entirely secure simply by signing up for AAA’s free service. If I were a member, though, and had the chance to snag a complimentary Essential level plan, I would probably go for it. After all, you can’t go wrong with something that’s free.

What If You Are Not an AAA Member?

Not everybody is an AAA member, but there are other alternatives:

- Experian – AAA’s free service is provided in partnership with Experian Identity Protection Service. Even without the AAA membership, you can get prime identity theft protection for as low as $ 9.99 (and a free month). Maybe it is not free, but indeed affordable to keep your identity safe.

- myFICO – Another great alternative is the notorious myFICO service. You can get a great deal that includes (besides identity theft protection) credit reporting services.

ProtectMyID by AAA

Summary

We like the free version of ProtectMyID for those who need limited identity protection. Otherwise, we prefer working directly through Experian, which gives you access to your official FICO score.