Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Synchrony Bank is a newcomer to the online banking market, and it offers an interesting blend of old-fashioned and high-tech banking. Like many online banks, it runs on a lightweight business model so it can offer lower fees and higher rates of return. Unlike online-only banks like Ally, Synchrony has a physical location in Bridgewater, New Jersey.

But don’t worry, you don’t have to live in or near New Jersey to open an account with Synchrony. You can take advantage of this bank’s award-winning CD rates and great Money Market accounts wherever you are in the US. This bank has over $46 billion in assets, and is FDIC insured.

Synchrony Bank Highlights

Synchrony Bank offers several options for customers and boasts an online storefront where you can choose which savings and checking options best suit you. The bank’s products include:

High Yield Savings Accounts: This savings account is service-fee-free as long as you maintain an account balance of $50. Interestingly enough, Synchrony’s high-yield savings account APY (0.60% APY as of 5/11/2022, which is subject to change) is even better than its Money Market APY. It beats out Ally and Capital One 360 by quite a bit. And, again, you can manage your money here over the phone, online, or by using an ATM card.

CDs: These CDs are known for their great interest rates. You can choose terms from 3 to 60 months, and open a CD with a minimum deposit as low as $2,000. Manage your CDs either online or over the phone.

Money Market Accounts: Money Market Accounts with Synchrony are service-fee-free as long as you maintain a balance of at least $1,500. APY on all accounts, no matter the balance, is 0.40% as of 5/11/2022. Synchrony’s Money Market rates are comparable to those of Ally, First Internet Bank, and Sallie Mae. As with all Money Market accounts, federal regulations limit you 6 transactions per month. But the good news is that you can easily transfer money online, over the phone, or using an optional ATM card.

IRA: If you’re interested in opening an IRA focused on stability over earnings, this is an option. You can open an IRA with Synchrony for just $250, or open an IRA CD with at least $2,000. The earnings for an IRA CD vary.

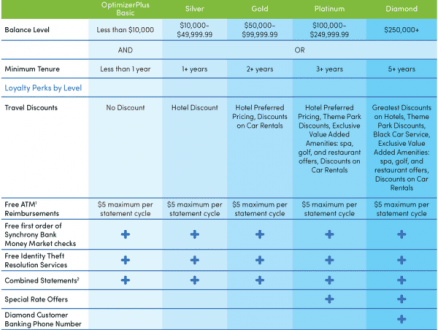

Perks: One of the interesting things about Synchrony’s Optimizer +Plus program is the Perks. With Synchrony, you can get rewards for more than just swiping your credit card. You can get travel-related perks for keeping a high balance with Synchrony or for remaining a loyal customer. Here are some of the perks you can get through the program:

Synchrony Bank Pros and Cons

Synchrony’s mostly-online business model means it can offer better rates of return for its customers. But there are other advantages to this online bank, too.

- Excellent rates. The primary advantage of a Synchrony CD or savings account is the APY. The rates are competitive with those of other online banks, and Synchrony’s high-yield savings account beats out even the best-known online savings accounts out there.

- Simple to open. You can open an account with Synchrony online in a matter of minutes. You just need your Social Security number and Driver’s License/Military ID/State ID Number.

- Easy account management. Like other online banks, Synchrony operates mainly on an online account management format. But it also has a physical location that locals can use, as well as a customer service line that allows you to manage your account over the phone.

- ATM reimbursement. The bank offers up to $5 in ATM reimbursements per statement cycle. This isn’t a lot, but Synchrony also focuses on savings accounts, rather than spending accounts. So you’re less likely to use the ATM for these accounts on a regular basis.

- Free money market account checks. Avoid ATM fees altogether by using checks for your money market account, instead. Your first order is free when you open an account.

- Security threats abound. Synchrony, like all of today’s good online banks, takes measures to protect against security threats. But online banks – and even traditional banks with online components – are always somewhat vulnerable to security threats.

- Transactions can take longer. Using your ATM card with Synchrony is exactly like using an ATM card with another bank. But putting money into your account or moving it to another account can take a bit longer. This is especially true if you need to mail in a check or get a withdrawal check in the mail.

- Moving away can be complicated. If you decide you don’t like your physical bank, you can go in and quickly close out your accounts. This process with an online bank can be more complicated and can take longer. So don’t open an online-only banking account unless you really plan to stay with that bank – especially since banks like Synchrony charge monthly maintenance fees if your account balance gets too low. You can’t just pull out all your money and not deal with closing the account.

Synchrony Bank offers excellent rates on CD and high-yield savings accounts. Before you open an account with them, get the details here in our Synchrony Bank review.

Bottom Line

Synchrony could be a great option if you’re looking for a place to stash your emergency fund. Its low balance requirements and top-notch rates of return on high-yield savings accounts cant be beaten. And its CD rates are good, too, so it could be a good option for a CD ladder style savings plan. Just keep in mind that it’ll take longer to deposit and withdraw your funds, and that you won’t be able to check-in with your banker in person.