Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

This is the sixth day of our 31-Day Money Challenge. Over 31 days we’ll publish 31 podcasts, each designed to help you move closer to financial freedom. Yesterday we interviewed YNAB-founder Jesse Mecham on the 4 rules of budgeting. In today’s podcast, we talk about the one-n-done way to save serious money.

Sponsors: The 31-Day Money Podcast is sponsored by Betterment and Empower. Betterment and Empower are two tools you can use to make investing easier, less expensive, and more effective.

A Story

Imagine a family trying to save money in three different ways. First, they decided to cut back on how frequently they ate at restaurants. Second, they spent hours clipping coupons to save money at the grocery store. Finally, they switched from an expensive cell phone plan with a 2-year contract to a prepaid cell phone, saving $30 a month.

How do these three approaches to saving money compare?

Cutting back on eating out is a lifestyle change that can save money. But it is a sacrifice for many. More importantly, you only save money so long as you continue to make the sacrifice.

Clipping coupons is not as much of a lifestyle sacrifice, although it does take work. And as with eating out less, you have to keep doing it in order to save money.

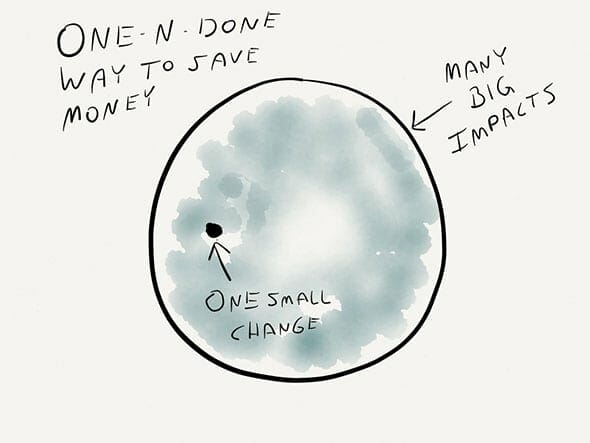

And that brings us to the third example. By making just one change to a cell phone plan, you can save money each and every month. There’s little if any sacrifice to your lifestyle. There is no effort involved after the initial work to change plans is complete. That’s what I call the One-N-Done method of saving money, and that is the topic of today’s podcast.

The One-n-Done Approach to Saving Money

This approach to saving money is extremely easy to do. In today’s podcast we walk through the following three steps:

Step #1: Write down every monthly bill you have including the amount. For loans, you should include the interest rate you are paying.

Here is a list of common monthly bills:

- Rent or Mortgage

- Credit Card debt

- Car loans

- School loans

- All other debt

- Utilities (electric, gas, water, trash service)

- Internet, cable, home phone, and cell phone

- Netflix and other subscription-based services

- Insurance (car, life, health, homeowners)

To make sure you haven’t missed anything, check your credit card and bank statements.

Step #2: Once you have a complete list, ask the following three questions for every item on the list:

- Do I really need this?

- Do I need exactly what I have?

- Can I get what I need for less?

In the podcast, I cover a lot of examples of ways to save money on monthly bills. You’ll also find a lot of ideas in the resources listed below.

Step #3: Execute. Once you have your list and know how you can save money, it’s time to make the changes. This often involves a lot of phone calls.

We’ve covered this one-n-done method before in our newsletter. In 2013, I received a ton of emails from newsletter subscribers sharing with me just how much they have saved. For some, it may be $50 a month, and for many, it’s hundreds or even thousands of dollars each month.

Podcast of the Article:

Resources

- 0% Balance Transfer Credit Cards

- Auto Insurance Quote

- Life Insurance Quote

- Health Insurance Quote

- 15 Ways to Slash your Cell Phone Bill

- 20 Inexpensive Ways to Lower Your Utility Bills

Day 7: 20 Painless Ways to Save Money

(Personal Capital is now Empower)

Empower Personal Wealth, LLC (“EPW”) compensates Webpals Systems S. C LTD for new leads. Webpals Systems S. C LTD is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC